“Start A Business”, They said…

By: Philmore Sweets

As the world waits for no man, or woman, everyone’s had the “ahah” moment. The moment, the brilliant idea of starting a business. It’s scary, it’s putting it all on the line. It’s all on you. Not everyone can do it, and not everyone who does succeeds. It’s a lot of work, but the fulfillment of building something, of knowing that you did it will serve you well in your entrepreneurial endeavors. After all, your first attempt at business is most likely going to fail…and fail hard. Keep at it, keep that drive that burns you. A very few can understand it, and most will doubt you. If not outright to your face. If you are willing to take that leap into the world of business, have that brilliant product or service and don’t know where to start? There are a few things you need to know kickoff your journey.

After you have the idea, the first thing you need to do is decide on a name. The second, go get your articles of organization, EIN, and a bank account. Articles of Organization is what you get when you officially register your business in the state you intend to do business in. The EIN, is the Employer Identification Number, it’s the social security number of your business. Making it a ‘legal person’. Without the EIN, and a bank account, you won’t be able to apply for a loan. You NEVER use your own money to start a business, unless it’s a non-profit. If you need more information, the best website and information is at the Wells Fargo. It will guide you from point A-Z. Best of luck, get ready for the long nights and cheap dinners.

https://www.wellsfargo.com/financial-education/small-business/?linkLoc=fn

Six Tips to Surviving Banking

By: Philmore Sweets

Six tips for the Young & Hungry

- DO NOT Opt-in Opting in to Overdraft Protection, or any bank product that will cause you to go into debt. Stay away!

- Learn Your Account Number It’s just principle, you always want to have access to your money.

- Watch Your Money Nobody likes the word ‘Budget’, but keep an eye on your account. Use your bank’s online banking and tools to help manage your money.

- Save! Save! Save! If your job has a 401k, 403b, IRA, Roth IRA, or any other investment vehicle use it. Interest compounds(look it up).

- Credit Cards? Can you pay a credit card bill every month? If you are able to, you will save yourself thousands of dollars over your credit life.

- Prepare yourself for the future Money Education is for everyone. Don’t be the one that falls behind. Information is out there. Use it.

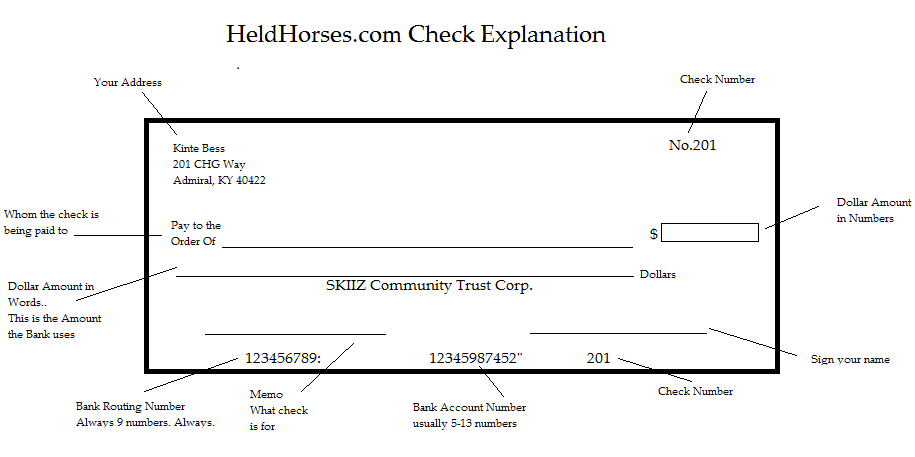

HeldHorses.com Check Explanation

By: Philmore Sweets

Hey! *whispers You Need A Loan?

It’s part of the “American Dream”, owning your own home or building your own business. For most, it will only be that, a dream. Some don’t want the bother of a long-term commitment, others have never put themselves in a position to do either. No matter what the reason for not, everyone has thought about it. There are many reasons to buy a home or start a business, like building equity in the property, being in a stable place with your own privacy, or pride in building something from the ground up. HeldHorses.com aims to familiarize you with some of the terms and numbers lenders and bankers will use to either grant or deny you a loan.

Types of Loans

- Adjustable-Rate Mortgage(ARM): No matter what, unless it’s a short-term loan…Stay Away! See 2008 Great Recession.

- FHA Loan: Federal Housing Administration, Loans insured by the Government.

- VA Loan: Dept of Veteran Affairs, for military and their families.

- Fixed-Rate: Loans that have the same interest rate for duration of loan.

- Commercial Loan: Debt financing that goes towards a business.

- Residential Loan: Debt financing that goes towards a family residence.

Terms and Info

- 28% of total income allowed for monthly payment.

- Do not close or payoff open credit, or ongoing debt. Its shows ability to repay.

- Amortization: The repayment schedule of the loan.

- Appraisal: The estimated value of the property.

- Closing Costs: All fees associated with closing of a loan.

- Debt Service Coverage Ratio(DSCR): Compares property’s annual net operating income(how much made from rental property) to it’s debt service

- Debt Service: Interest and Principal paid on a loan for a year.

- Debt to Income Ratio: Total income compared against total debt for a year(includes rent or house payment).

- Escrow: A free account set up by the seller for taxes and property insurance.

- Interest: The cost of borrowing on a loan.

- Loan to Value Ratio(LTV): The value of a loan against the lesser value of a property or its purchase price. Ex. Loan ($90k)/ Value($100k)= .9 or 90%. The generally accepted Max LTV is 80%.

- Proposed Rental Amount: Total amount of income from a rental property. Used to assess ability to repay on an investment property.

- Principal: Outstanding balance on a loan.

- Private Mortgage Insurance(PMI): Insurance paid on a mortgage whose downpayment doesn’t cover 20% of Loan to Value Ratio.

[mlcalc]

Make The Money Work

The Money. We all need it, we all can use more of it. From ‘Six Tips to Surviving Banking’ as a young adult, to setting oneself up for a bright future. This page is all about information. What should be taught in school can now be jump-started here. We’ll take a look at the numbers lenders use to grant business loans and mortgages..and much, much more. So if you need brushing up, or have young ones about to dash out into the new world, don’t let them go without visiting HeldHorses.com.